By Amin Kef Sesay

On Friday 23rd July, the Rokel Commercial Bank had its 48th Annual General Meeting (AGM) in Freetown. The mood was convivial and pensive with shareholders eager to get informed about the Bank’s 2020 balance sheet and statements of accounts and other broader issues relating to the growth, transformation and sustainability of their beloved institution.

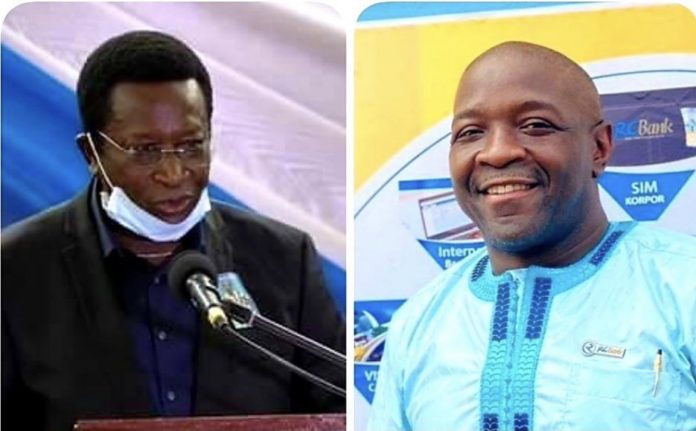

Like previous ones, last week’s AGM was manned by remarkable and notable professionals, like Dr.Prince Harding, Chairman of the National Commission for Privatization (NCP) (the NCP represents the Government of Sierra Leone as prudential shareholder in the Bank), Buffy Bailor, Chairman of the Rokel Bank Board. Bailor is a consummate accountant who is also President of the Institute for Chartered Accountants for Sierra Leone, Haja Wurie Bah and Marcella B. Jones. Amongst the shareholders was our own son of the soil, a seasoned ex-Governor of the Central Bank, resilient banker and economist, Dr Sampha Koroma and well known citizens, such as Rev. Acher-Campbell, but to name a few .

Worthy of note was the hallmark of the event- which was when the astute and articulate Managing Director, Dr Walton Gilpin who took the audience through a brilliant presentation on the Qualitative and Quantitative approaches he had adopted to manage the growth as well as guaranteeing the future of the bank.

Gilpin in his flawless oratory explained the new system the bank has adopted for fraud prevention, financial inclusion, positive profit trajectory, digitalization, financial depth, bonus shares and dividend.

According to Gilpin, all these new policies are encapsulated in the Bank’s strategic plan which seeks to put the Bank on an enviable platform of unlimited growth and expansion.

He pointed out that the Bank was part of the overall financial system, and therefore should operate in a syllogistic manner, contributing to overall economic growth and yielding positive returns to equity for the shareholders.

The Managing Director’s presentation drew uncontrollable applause from the audience and one individual that was notably impressed by Gilpin’s presentation was the Chairman of the NCP, Dr Prince Harding who could not resist the urge to stand up and boldly acclaimed Gilpin.

According to the NCP boss, the Rokel Commercial Bank’s new strategic plan is clearly in sync with the Government of Sierra Leone’s policy on economic development with special emphasis on streamlining the financial sector into a more viable component in its strive to attaining a key millennium Development Goal of achieving middle income status by 2035. The Chairman of the Bank’s Board, Buffy Bailor was perhaps rather less restrained when he stated:

“Special thanks go to the CEO/MD. Dr Walton E Gilpin for his innovations, outstanding collaborative relationship with the Board and his strong and tireless efforts in directing the Bank’s day to day activities and for his highly fruitful engagements with stakeholders…”

According to the 2020 Statements of Accounts, the Rokel Commercial Bank has recorded a profit (before tax) of Le83.5 Billion in 2020 representing a 5% increase of Le79.4 Billion from the previous year. With retained earnings increased from Le966 Million in 2019 to Le44Billion in 2020 (over 4000 % increase), the Rokel Commercial Bank was reported to be financially stable and had met all prudential requirements of the regulatory agency.