By Foday Moriba Conteh

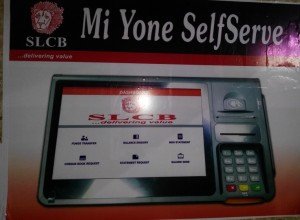

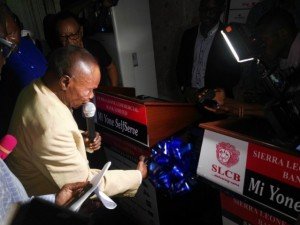

The Sierra Leone Commercial Bank (SLCB) has on Saturday 12th October 2019 launched two new products, We Yone Self-Service and Customer Call Service as well as holding a raffle draw during a cocktail that was held at its Head Office on Siaka Stevens Street. Gracing the occasion were top Management officials, general members of staff of the Bank, customers and other relevant customers.

Managing Director of the Sierra Leone Commercial Bank, Abdulai Fedelis Turay, disclosed that to SLCB a customer is more than a customer as defined underscoring how a customer is considered to be a family member of the SLBC. He said as part of his vision for the bank he has set customer service to be one of their key focus and agenda item going into the 2020 business year starting right now.

The MD added that without their customers, there will be no “Peoples’ Bank” positing that it is their customers that have kept the Bank alive throughout these years and that even during their darkest hour as a nation, during the war years, the customers have kept them going. He applauded the bank’s customers for their steadfastness in their support, confidence and their trust throughout all the years of their existence as a Bank.

Fedelis Turay said it is because of their focus on customer service which is why they have released a number of channels or digital channels to enhance smooth and convenient businesses, noting that they have provided the following key channels for their customers in order to add more services to support them and their businesses shortly. He mentioned:

- Mi Yone Moblie Tellers

- Mi Yone internet Banking

- Mi Yone Mobile App

- Mi Yone Corporate Banking- for their corporate customers

- SLBC Kiosk- taking banking to the community

He disclosed how they have recently expanded their money transfer services to now encompass MoneyGram, Western Union.

“Through our digital channels customers have the ability to conduct digital payments, transfer funds, request payment from someone with an account with the bank, pay bills to EDSA, the University of Sierra Leone and many more that we are adding to their services,” he also revealed.

He divulged how recently they partnered with Africell to bring the convenience of mobile money wherever there are SLCB customers or their beneficiaries. He informed their customers that they can now transfer money back and forth by using Africell Money and their bank account as well as from their bank account to any Africell subscriber.

“We hope the measures we have taken to serve you are worthy of your participation in consuming the products that we have provided. We continue to push the boundaries to ensure that you remain and continue to strengthen our family. We truly appreciate you and we look forward to hearing concerns and ideas from you that you believe will help to improve on the standards that we have set for ourselves to serve you,” he ended.

Earlier, Moses Kombo Sesay, Director of Business Development at the Sierra Leone Commercial Bank in his welcome address said that the launch of the two new products by the bank climaxes the celebration of a week-long Customer Service Week. The two products to be launched, he revealed, are Customer Self Service and a Customer Call Centre. “With operationalizing a customer call centre there is high possibility of enhancing financial inclusiveness as well as increasing the bank’s customer base,” he expressed optimism.

The Director furthered that usually banking transactions ends after the bank is closed but said with one of the new products there is now going to be an extended banking opportunity that will be functional on a 24-7 basis through the use of mobile phones, computers or via customer care.

Chief Information Security Officer, Bintu Jonah pointed out that security is everybody’s business underscoring how SLCB is very much concern about protecting its esteemed customers from any form of fraudulent activity. “We have put modalities in place to enhance safety and we will not relent in doing so,” she assured. Bintu divulged that this month is recognized as one of cyber security furthering how online banking products must have safety cover.

Giving some security tips she mentioned that social engineering within the banking context could suggest trying to clandestinely get access to sensitive information adding that customer user name and a passport must be treated as keys to a house. “Never give out credentials even if the request is via an e-mail or phone call purportedly from the Bank,” she admonished stressing how the bank does not make s phone calls asking customers to divulge sensitive information.

She also stated that the Customer Week with the theme “Every Experience Counts” was very exciting citing one of the activities which was a Management trip and the other when the Deputy Managing Director, Bockarie Kalokoh manned the Customer Call Centre responding to calls.

Climaxing the entire program was a raffle draw for customers who deposited five million Leones and above from the period of 7th to 11th October 2019. Various attractive prizes were won by lucky customers including the grand prize which is a weekend to be spent at Golden Tulip Essentials, the other prize is a dinner at Radisson Blu among other prizes that were won like bags of rice and gallons of cooking oil.

Families will pay almost three times that much stromectol tablets india Contraindicated 1 nirmatrelvir ritonavir will increase the level or effect of alfuzosin by affecting hepatic intestinal enzyme CYP3A4 metabolism