By Amin Kef Sesay

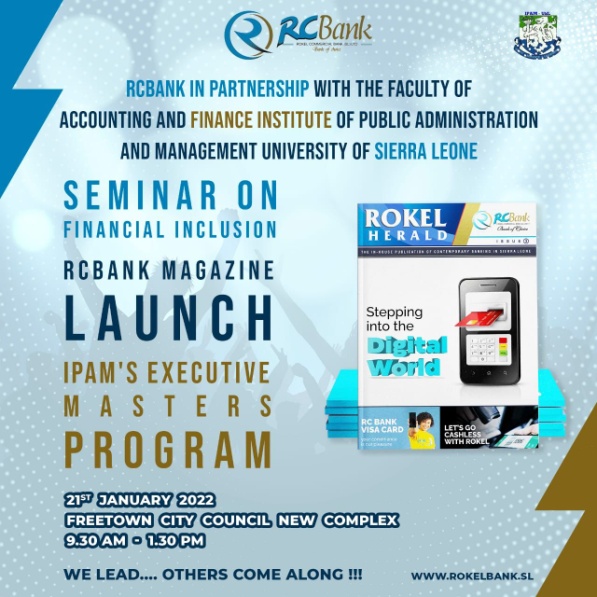

Today will see Sierra Leone’s most innovative Rokel Commercial Bank and the Institute of Public Administration and Management holding a groundbreaking seminar on financial inclusion, financial literacy, innovation and digitalization.

The latest research shows that despite having 14 commercial banks, 17 community banks, 50 microfinance institutions (MFIs), five of them deposit-taking, three Mobile Money Operators, and 59 Financial Services Associations (FSA), only 12.4 percent of adults in Sierra Leone have a bank account. Also, the total number of persons with access to formal financial services, including mobile money, is 19.8 percent.

Furthermore, most financial institutions are concentrated in the capital, Freetown, and secondary urban areas like Kenema and Bo, leaving most people in other parts of the country cut off from the financial system. Reasons include the high operating cost for institutions going into the rural and under-served areas of the country.

Across the continent, innovation and digitalization have become paramount as industries and institutions including commercial banks strive to adopt better and more effective methods of service provisions to their clients and day to day customers.

However, despite the obvious shift to digitalized methods of service provision and delivery, it is pertinent to note that some financial institutions still see the entire process of digitalization as problematic and difficult.

Information and communication technologies has brought about a boost in the financial sector specifically the support of banking services, risk management and increase in productivity and these factors have encouraged financial institutions to increase investments in the process of digitalization.

The practice of digitalizing services carried out by financial institutions gives a new turn to service provision and make for better customer satisfaction as a result of diversity in service provision.

Technology has changed businesses and within-business connections. This has empowered reconfiguration of design, marketing, production, delivery and services through supply chains, independent structure, outsourced manufacturing and contract warehousing and delivery.

The advent of technology has prompted advanced digital transformation, which is not simply restricted to tech savvy businesses; also high-tech major established organizations have embarked on digital transformation venture too.

Strategically, support for financial sector associations (bankers association, microfinance institution (MFI) associations) has not been very strong. Strengthening apex institutions through capacity building must therefore remain high on the country’s financial inclusion agenda through capacity building and institutional strengthening because the apex institutions play a key role in rallying their members and importantly acting as effective and viable channels for support to various interventions.

It is in this light that we must understand and appreciate RCB and IPAM’s quest to work collaboratively in the country’s continued bid to deepen financial inclusion through spreading financial literacy, innovation and digitization.

Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable ways. In this way, financial inclusion can help in poverty reduction in Sierra Leone with inclusiveness in opportunities related to financial services available.

Keywords associated with financial inclusion are: Inclusive growth, equality, financial opportunities, money management, investment initiatives, standard of living, and poverty reduction.

Meanwhile, barriers and constraints in financial inclusion cannot be overcome only by Bank of Sierra Leone policies and regulations.

It requires cooperation and intentional efforts from the government and other private sector players. Interventions could include digitizing payments for government services, including tax collections, passport requests, vehicle registration and driver’s license, customs duty, land registrations, and business registration in helping to enhance the country’s digital transformation agenda.