By Amin Kef (Ranger)

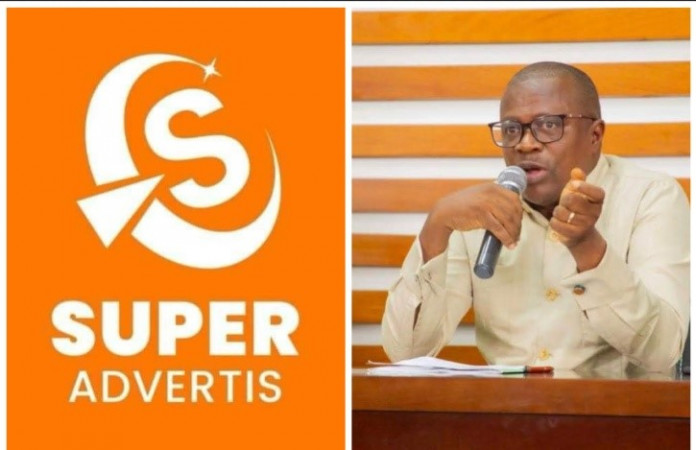

The Director of the Financial Intelligence Unit (FIU), David Borbor, during a press briefing held on Tuesday January 23, 2024 at the Ministry of Foreign Affairs Conference Hall, confirmed an ongoing investigation into a recent financial fraud perpetrated by Super Advertis, an illegal company, which preyed on numerous unsuspecting Sierra Leoneans.

He revealed how they have directed mobile companies to freeze the accounts of 30 agents associated with Super Advertis further revealing that the total amount involved is NLe3.4 million. The FIU Director also intimated that the company is owned by a Chinese individual giving assurance to the public that the investigation is actively ongoing to uncover additional financial details.

According to him, his office will provide further updates to the public regarding the progress and the next steps in due course.

He said this is not the first instance of such fraudulent activities, citing a prior success in dismantling a similar operation named “My Coin.”

During the briefing, Borbor urged Sierra Leoneans to exercise caution and refrain from falling victim to such scams, emphasizing that prevention is better than cure.

Subsequent to the Press Briefing, Director David Borbor reiterated that the FIU had frozen accounts associated with agents affiliated with Super Advertis in the country. The frozen accounts, totaling 3.4 billion old Leones, were linked to the sudden closure of Super Advertis earlier this month.

The scam dealt a blow to thousands of Sierra Leoneans who had invested substantial sums through the company’s application.

Addressing the legality of Super Advertis, Borbor revealed that the company operated without obtaining the necessary licenses from the Bank of Sierra Leone and the FIU, crucial regulatory bodies overseeing financial services in the country.

Furthermore, Borbor emphasized that Super Advertis did not seek the required licenses from regulatory bodies, prompting the FIU to investigate 30 accounts connected to agents operating through Africell and Orange Money disclosing how the frozen amounts are now subject to ongoing investigations.

The Director confirmed that the company was owned by a Chinese national, and relevant information had been provided to the Sierra Leone Police, with the matter currently under investigation. He said the FIU remains committed to determining the destination of the frozen funds.

In a press release dated January 4, 2024, the FIU, in collaboration with relevant stakeholders, announced an investigation into suspected unlawful activities by Super Advertis. The entity, utilizing various mobile money platforms, allegedly solicited deposits under the pretense of legitimate investments.

Describing the scheme as a “Ponzi Scheme,” the FIU explained that Super Advertis operated by reimbursing existing investors from funds contributed by new investors, rather than generating profits from a lawful business enterprise. Mobile money service providers, including Orange money and Afrimoney, have taken measures to restrict access to third-party accounts used by suspected fraudsters, cooperating with authorities in ongoing investigations.

The FIU cautioned the public against engaging with individuals or institutions offering investment opportunities, advising thorough due diligence before financial involvement.

As the investigation progresses, the FIU pledges to provide further updates and encourages the public to report suspicious financial dealings to the appropriate authorities.